When it comes to commercial real estate (CRE) investments, one question stands out above the rest: Should you invest in office or retail spaces for better ROI? The answer isn’t one-size-fits-all. Both segments offer distinct advantages — and equally distinct risks.

With shifting work cultures, evolving consumer behavior, and increasing demand for flexibility, investors in Delhi NCR and beyond need to take a closer look at how office and retail spaces stack up against each other. This article will break down the performance, potential, and pitfalls of both asset classes — helping you make an informed decision for your next CRE investment.

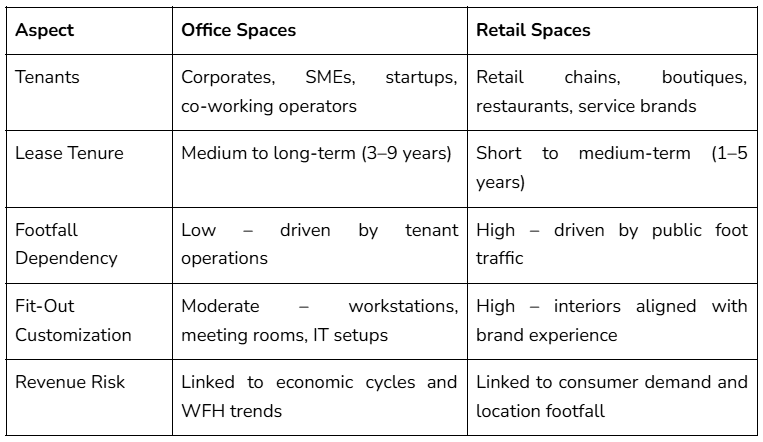

Understanding the Core Differences

Before diving into ROI, it’s essential to understand what makes office and retail spaces fundamentally different:

ROI Potential: Office vs Retail

ROI is impacted by many factors — rental yield, occupancy rate, lease tenure, and capital appreciation. Let’s break it down:

1. Rental Yields

- Office Spaces:

Office properties in Tier-1 cities typically offer annual yields of 7–9%, especially in well-connected business districts. The demand from IT, BFSI, and startup sectors continues to drive this figure steadily. - Retail Spaces:

Retail assets may command higher headline rents, but yields vary drastically based on footfall and location. High-street retail in prime zones may yield 9–11%, but in secondary locations, this could drop to 5–6%.

Verdict: Retail can offer higher yields in select zones, but office spaces offer more consistency.

2. Vacancy & Occupancy Risks

- Offices:

Demand for flexible workspaces has changed the office landscape. While Grade A offices in NCR are still in demand, remote work and hybrid models mean higher vacancy risks if the location or layout isn’t future-ready. - Retail:

Retail spaces are more susceptible to market shocks. Events like pandemics, online shopping surges, or hyperlocal competition can dramatically affect tenant turnover.

Verdict: Office spaces generally offer more stable occupancy when aligned with tenant preferences and business hubs.

3. Capital Appreciation

- Offices:

In core micro-markets like Cyber City, Golf Course Road, and Connaught Place, office space values have shown steady appreciation, driven by infrastructure growth and corporate demand. - Retail:

Retail spaces in established high streets or within malls often appreciate faster due to limited availability. However, they also face higher volatility, depending on shifting consumer trends and mall popularity cycles.

Verdict: Office spaces offer slower but steadier capital growth; retail can deliver spikes but with higher risk.

4. Lease Tenure & Stability

- Office:

Tenants usually sign for 3–9 years, often with lock-in periods and escalation clauses. This creates predictable income and lower churn. - Retail:

Lease terms are shorter, and tenant turnover is higher. Brands might exit or downsize with little notice if performance drops.

Verdict: Offices win for long-term income stability.

5. Fit-Out and CapEx

- Office:

Landlords often provide base fit-outs or contribute via rent-free periods. Tenants handle most interior customization. The capex burden is moderate and shared. - Retail:

Tenants demand heavy customization for brand experience — lighting, displays, flooring, etc. This leads to higher initial capex and often full landlord responsibility during vacancy.

Verdict: Offices are lower maintenance from an investment standpoint.

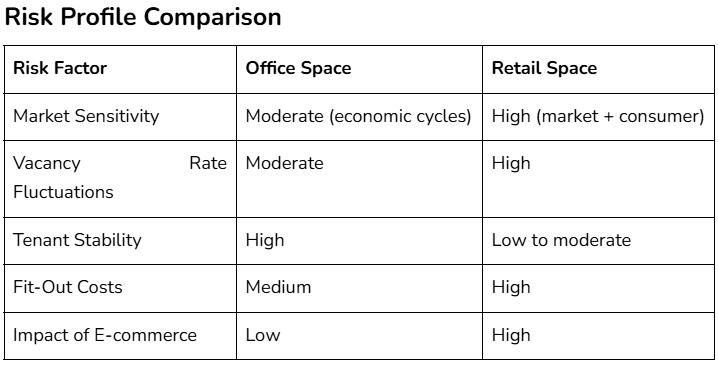

Risk Profile Comparison

The Delhi NCR Perspective: What Local Data Tells Us

Delhi NCR, particularly Gurgaon and Noida, has been a hotbed for commercial investment. Here’s a local snapshot:

- Office Market Trends:

With steady leasing demand from tech and BFSI sectors, the office absorption rate remains strong. Key locations like Udyog Vihar, Golf Course Road, and Sohna Road are seeing sustained demand. - Retail Trends:

High-street retail in areas like Khan Market, Connaught Place, and Sector 29 Gurugram) performs well. However, newer malls and untested locations often face churn and long vacancy periods.

If you’re considering entering this market, working with a flexible office leasing agency in Gurugram gives you access to high-demand listings with low downtime and long-term rental upside.

Which Is More Future-Proof?

Office Space Outlook (2025 & Beyond):

- Rise of hybrid-ready layouts

- Focus on employee wellness zones

- High demand for flexible leases and managed spaces

- Growth of co-working, especially in Tier-2 extensions

Retail Space Outlook (2025 & Beyond):

- Strong demand for F&B, experiential brands, and wellness

- Shift toward omnichannel and showroom-style formats

- High sensitivity to macroeconomic conditions and location density

Verdict: Office spaces, especially those adapted for hybrid use and shared services, offer a more predictable long-term investment path. Retail shines in premium pockets but demands more active asset management.

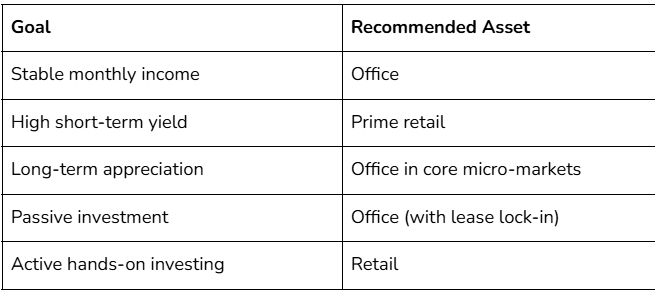

How to Decide: Investment Goals Matter

Your decision should reflect your investment profile and goals:

Due Diligence Is Key — Always

Whether you choose retail or office, one rule is universal: never skip due diligence. Assess:

- Tenant credibility and lease terms

- Market rent benchmarks

- Infrastructure and location growth plans

- Exit options and resale liquidity

- Local competition and saturation risk

Working with commercial RE investment consultants in Delhi NCR can help you assess deals with clarity and objectivity, minimizing risk and maximizing returns.

Final Thoughts: Office or Retail?

There’s no universally “better” option — but there is a better fit for your investment style. If you’re looking for stable returns, low management, and long-term growth, office spaces may be your best bet. If you’re comfortable with a bit more volatility and want to pursue premium rental upside, retail could deliver — especially in high-traffic, established zones.

Your best move? Combine market data, tenant insight, and location potential with expert advisory to make the right call.

Ready to Invest Smarter?

At Real Property, we help investors navigate the complex world of commercial real estate with clarity and confidence. Whether you’re exploring retail, office, or a hybrid portfolio, our expert team provides:

- Due diligence support

- Financial modeling & risk analysis

- Tenant sourcing & lease advisory

- Full transaction and legal coordination

If you’re seeking investment advisory for office leasing in Delhi NCR, we’re here to make your next move your smartest one yet. Contact Real Property today for a private consultation.